Advisor Partnerships

Compliance Peace of Mind

Built with employee benefits advisors in mind, our streamlined solutions simplify compliance management, giving you more time to strategically meet your clients’ needs.

Relieving Your Biggest Compliance Headaches

Reduce Your Risk

Reduce Your Risk

Increase Your Compliance Knowledge

Increase Your Compliance Knowledge

Ditch Manual Deadline Tracking

Ditch Manual Deadline Tracking

Divide Up the Compliance Responsibilities

Divide Up the Compliance Responsibilities

Keep Up With Legislative Changes

Keep Up With Legislative Changes

Get More Time for Other Things

Get More Time for Other Things

Don't sweat the deadlines.

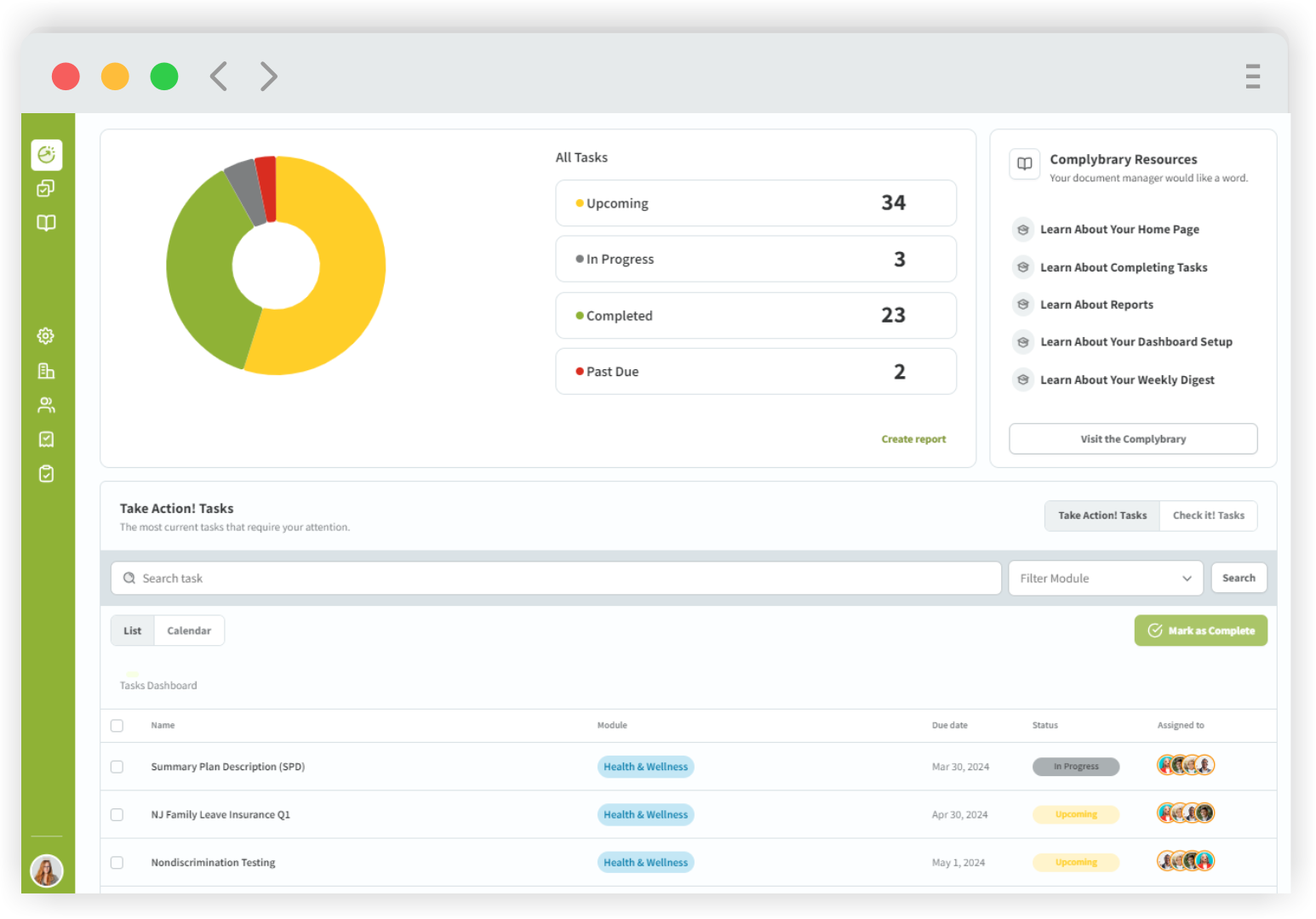

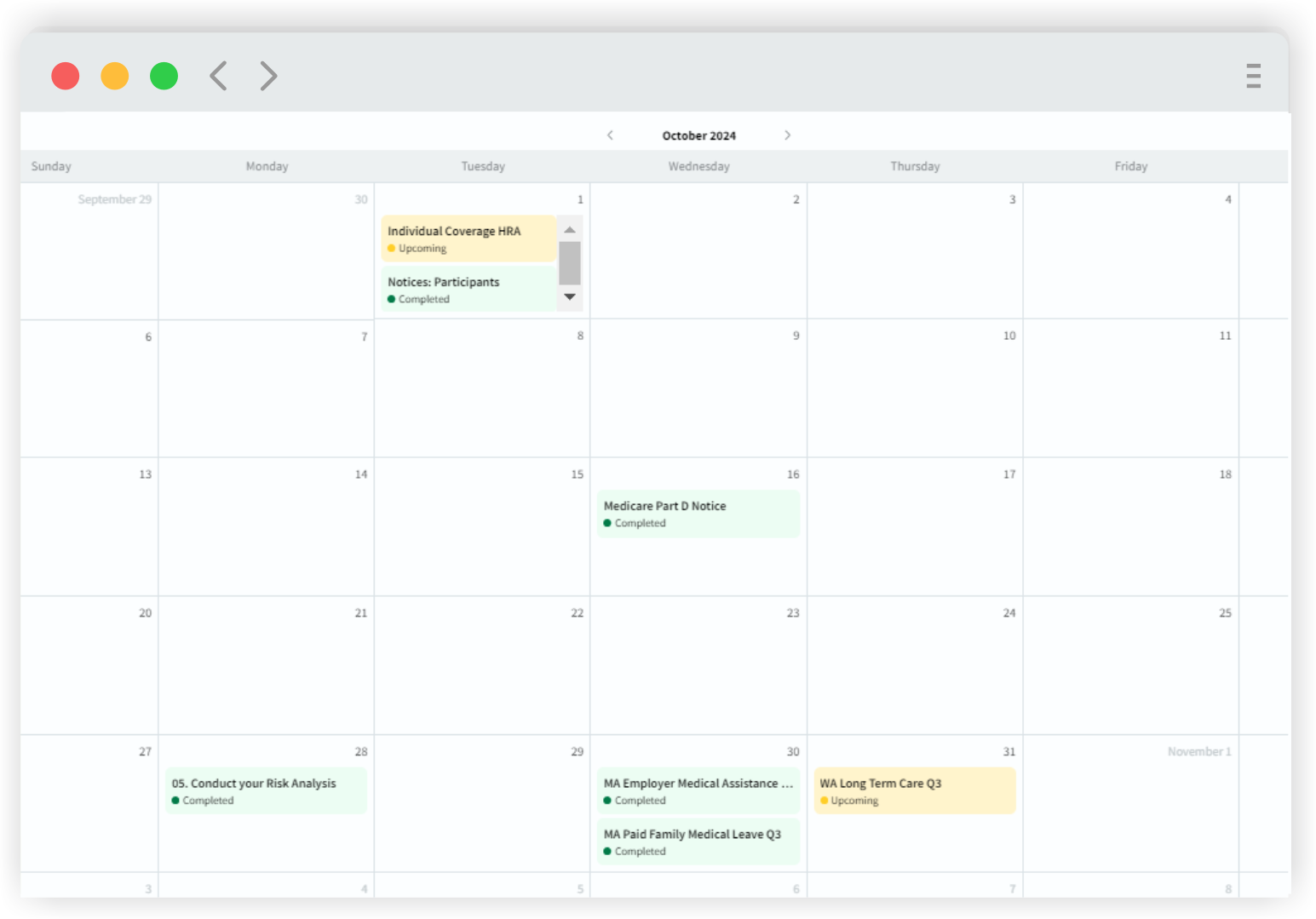

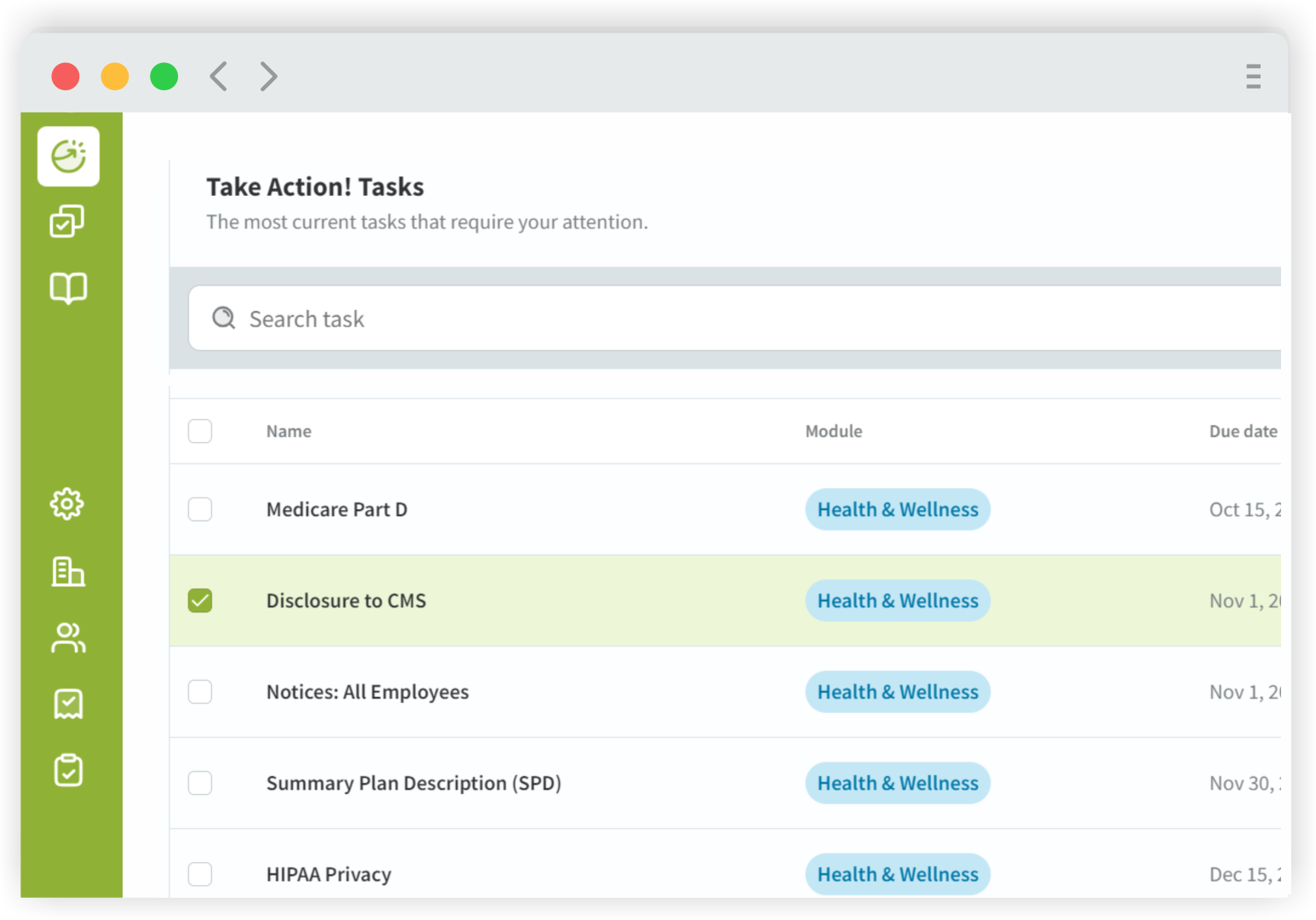

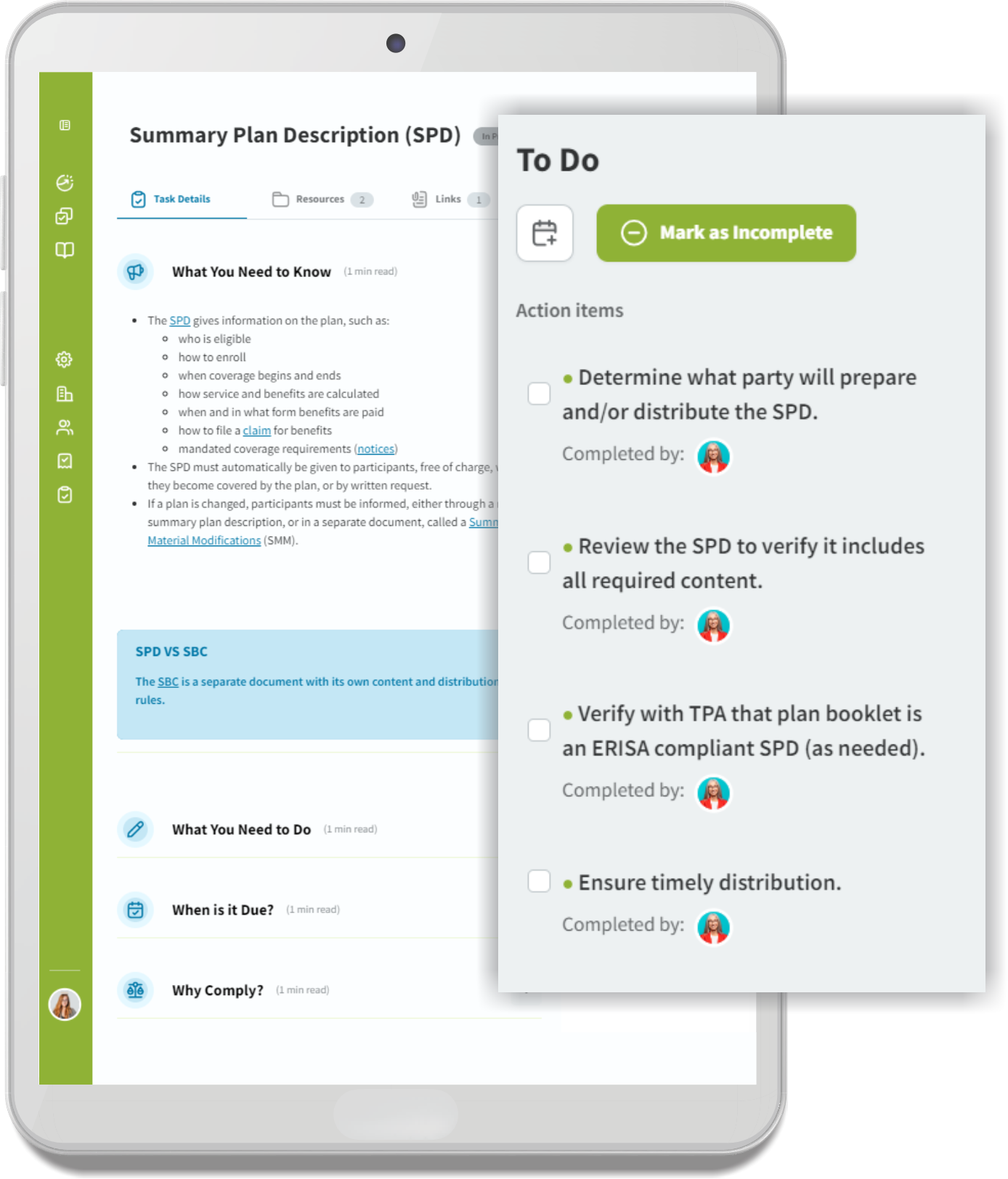

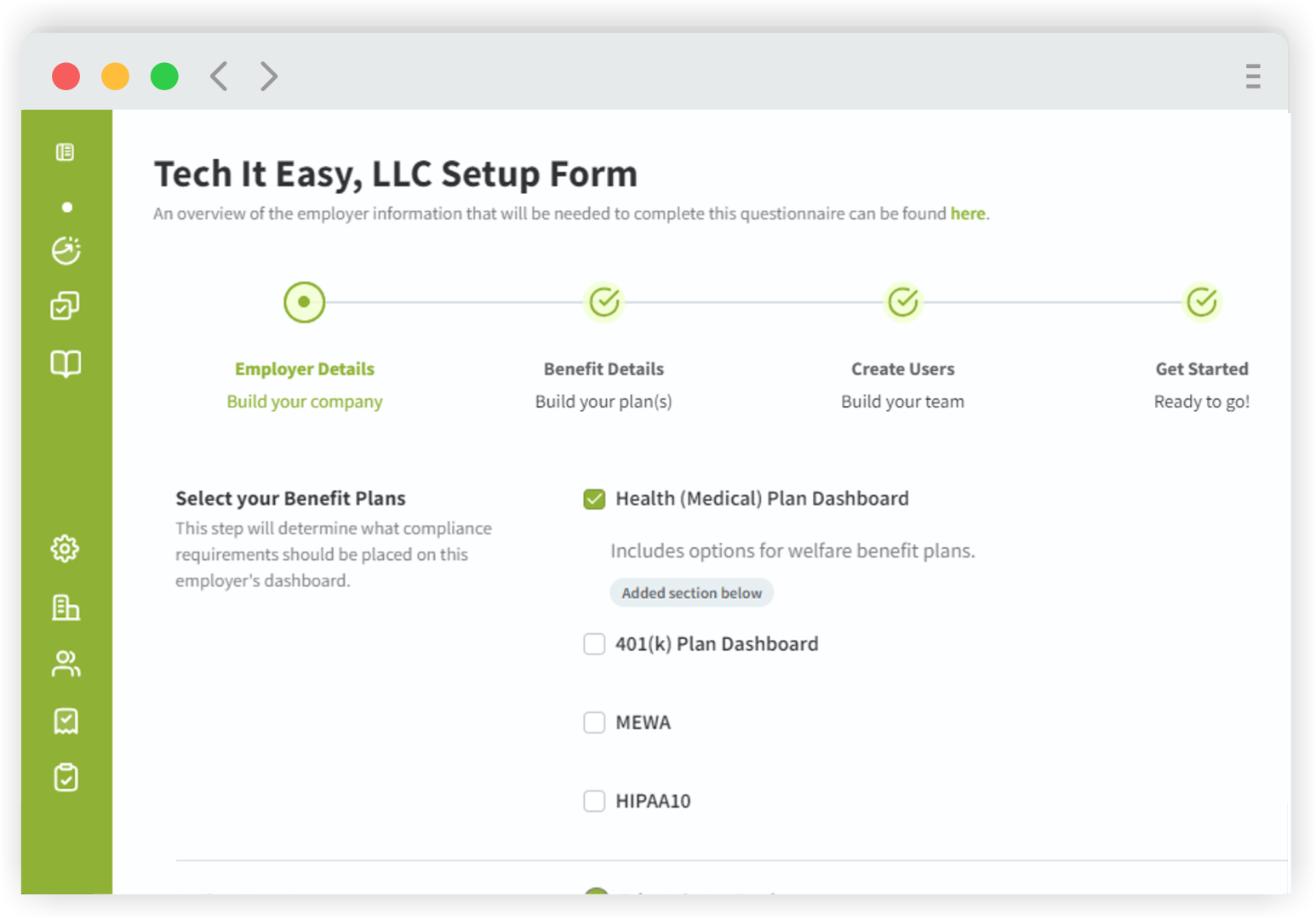

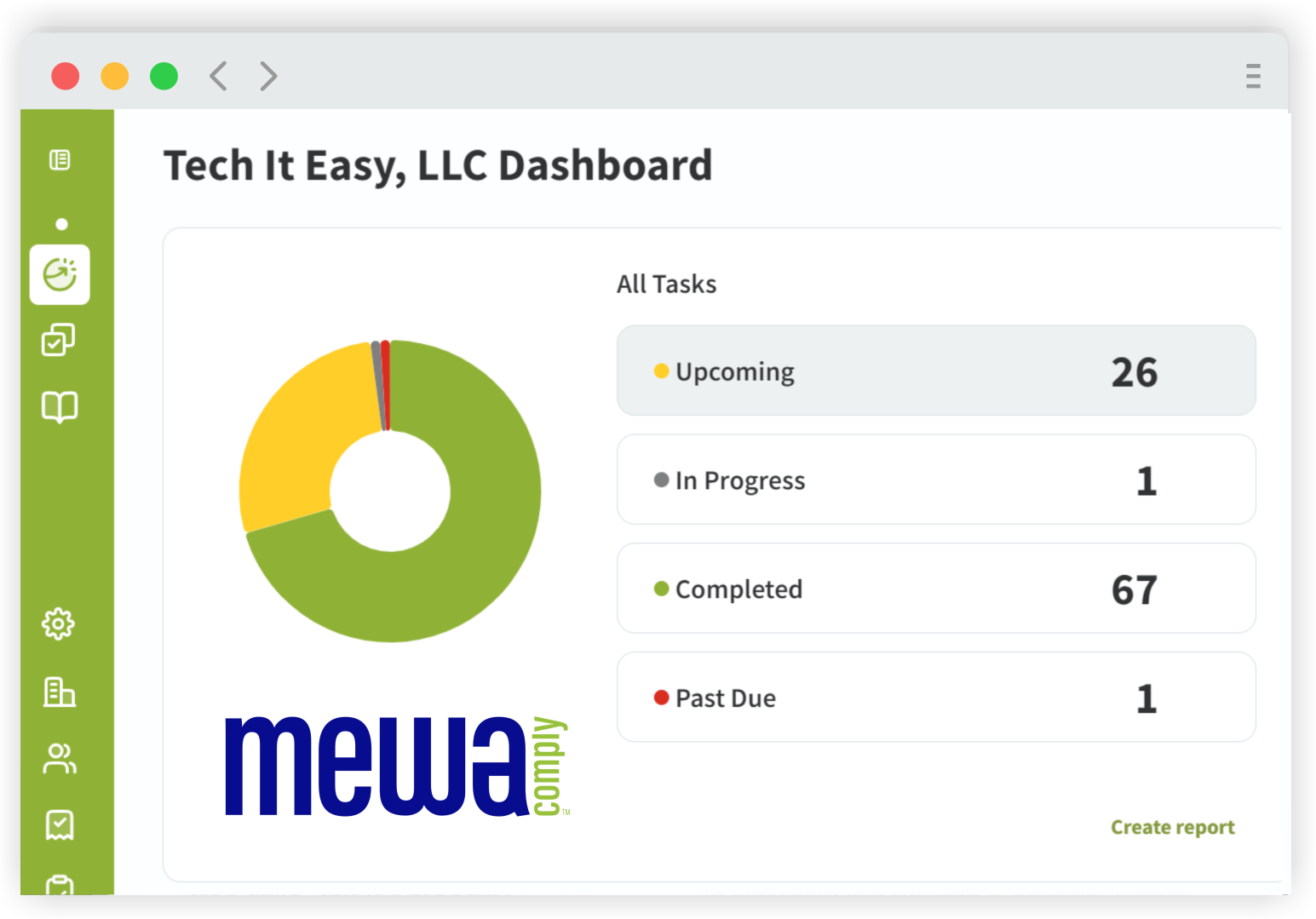

Each client’s Dashboard is a customized calendar based on their company and plan information. Their Dashboard tracks compliance due dates so you don’t have to manually track who needs to complete what when.

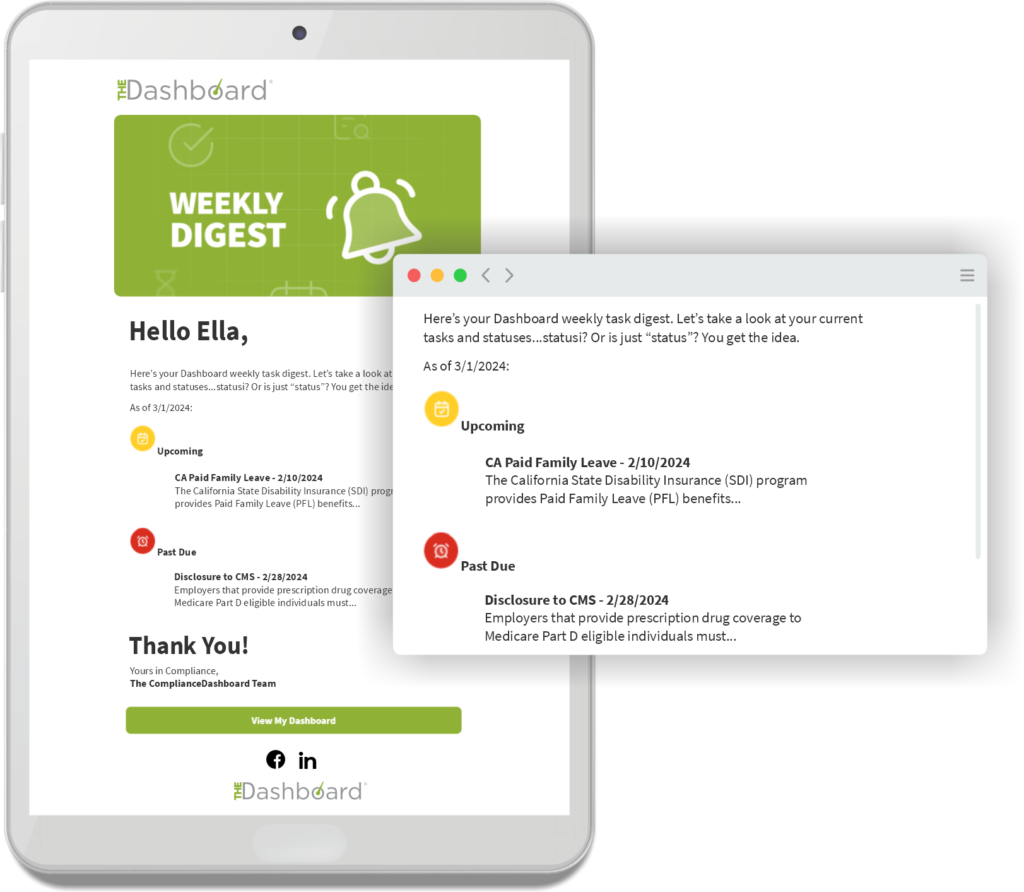

No more reminder emails.

The Dashboard sends a Weekly Digest email to your clients on your behalf. Each Weekly Digest gives clients upcoming and past due compliance tasks that apply to them.

Look like a compliance expert, even if you're not.

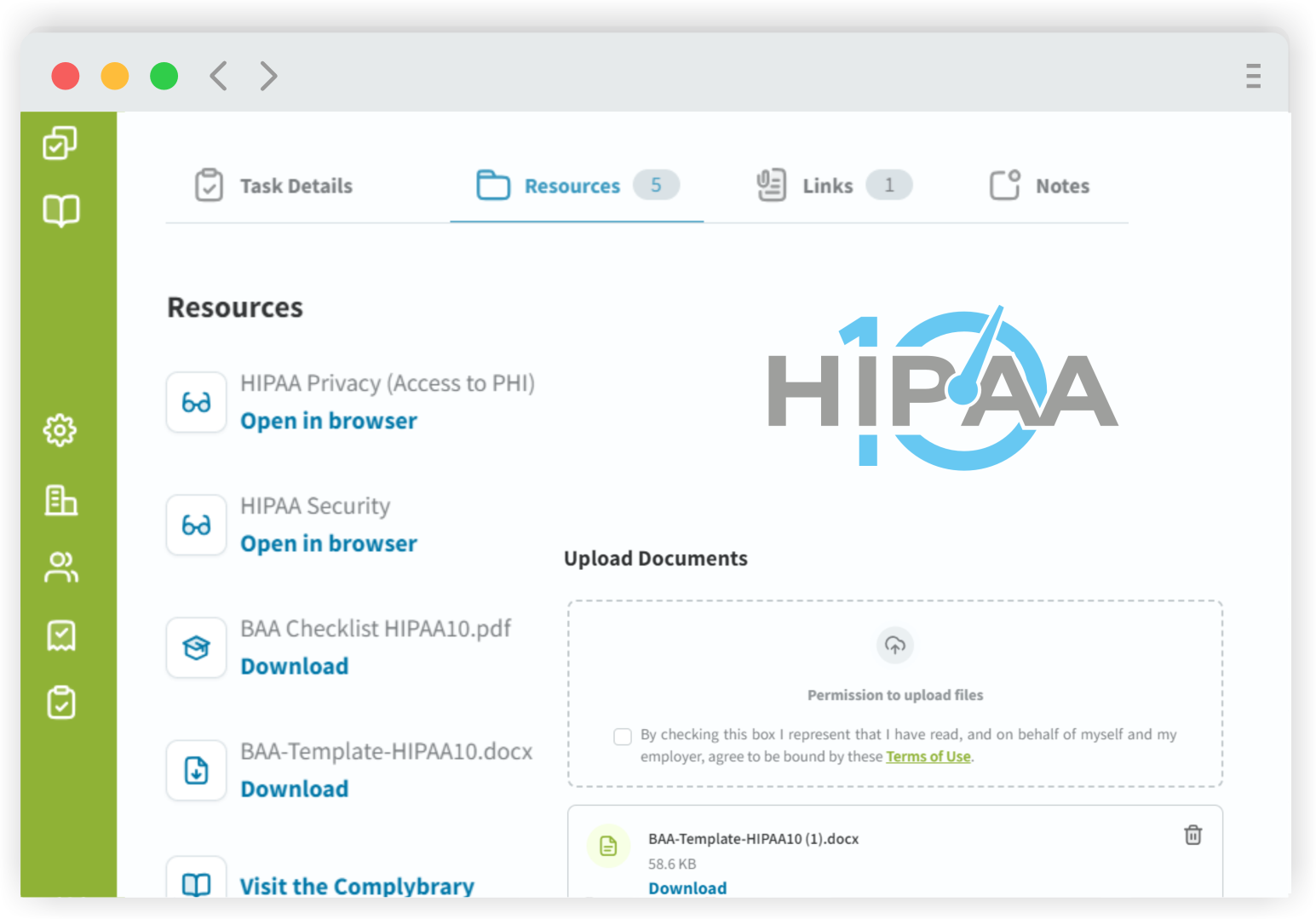

The Dashboard has step-by-step guidance for each compliance task, written with all levels of compliance experience in mind. Dig deep into a compliance topic with our Complybrary, full of deep-dive content, charts, guides, and webinars.

Be as hands-on (or hands-off!) as you'd like.

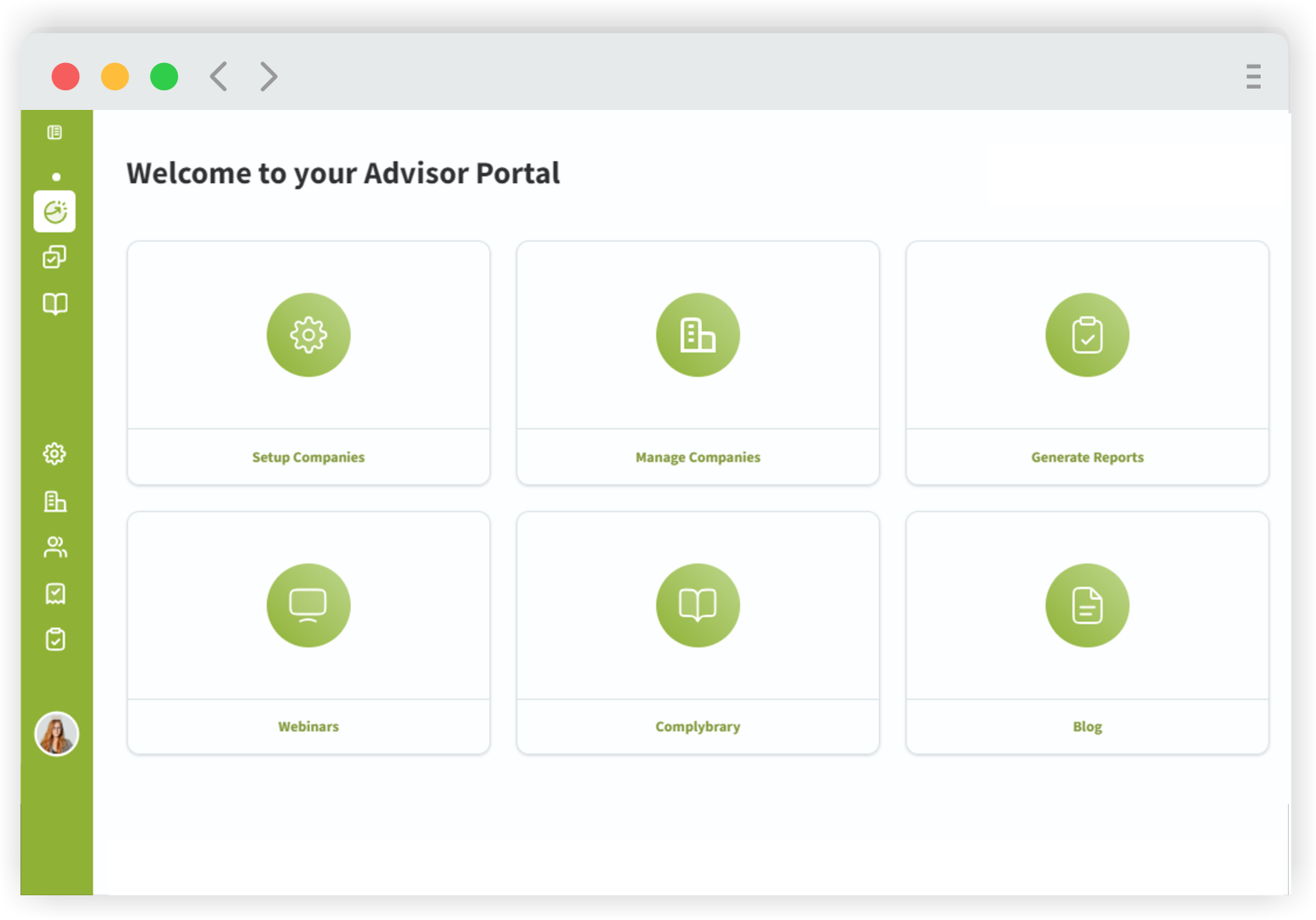

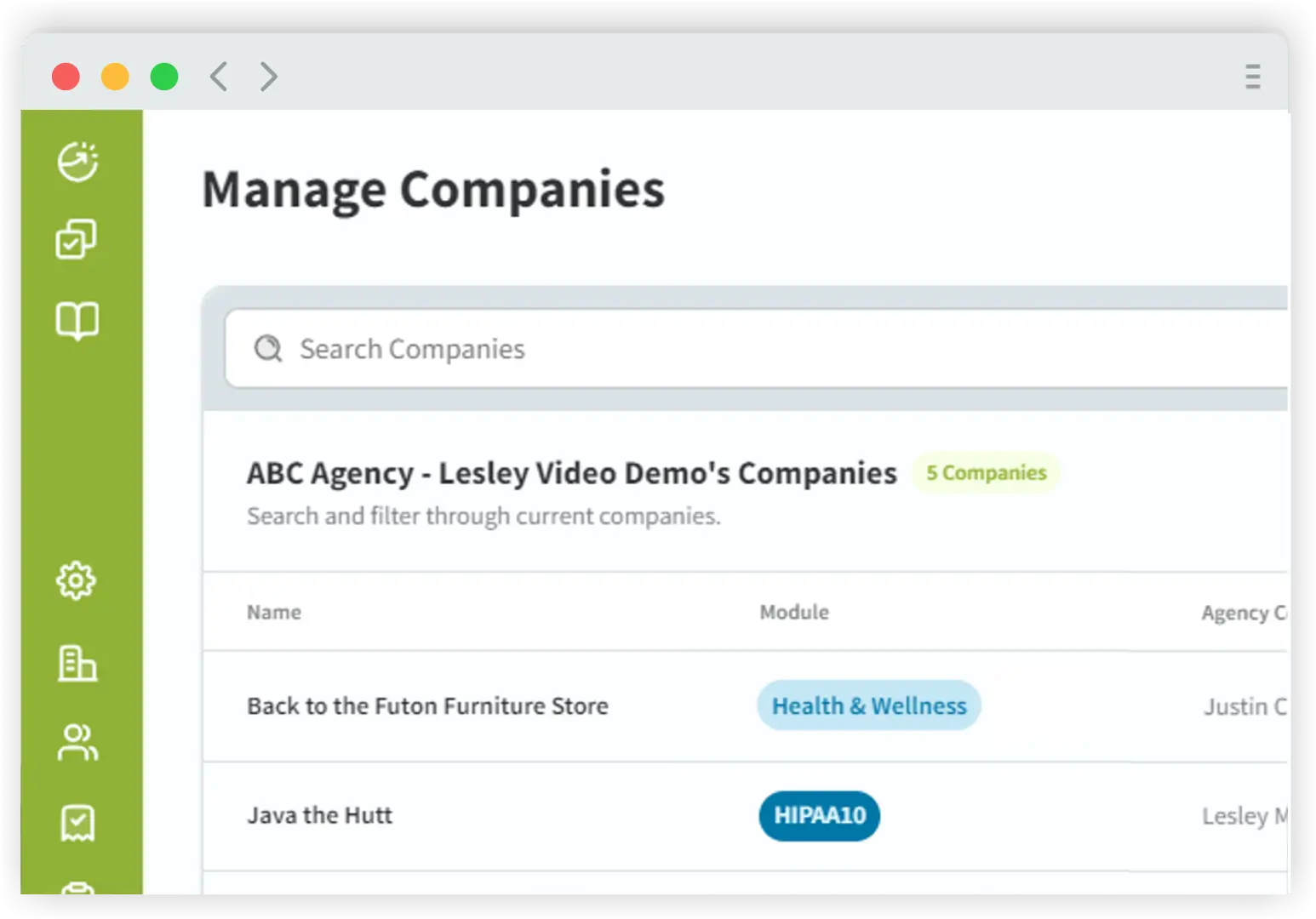

Your Advisor Portal makes client management a breeze. Want to be hands-on with compliance? Use on-demand reports to add compliance check-ins to your client communications, add notes to show off your agency’s compliance support, and upload compliance documentation. Want to be hands-off? Once a client is set up, The Dashboard’s proactive approach to compliance will still keep them up-to-date.

Looking for more compliance in your life?

ComplianceDashboard also provides HIPAA and MEWA/trust compliance solutions. Find out more!

Expanded Preventative Services for Plan Year 2026: Breast Cancer Screening

On 12/30/24, the Health Resources and Services Administration (HRSA) issued a notice including an important revision focused on “Breast Cancer Screening for Women at Average

Mental Health Parity Final Rule (MHPAEA) Under Review by Agencies

Attention HR pros and benefit brokers! Portions of the Mental Health Parity Rule (MHPAEA) are under review by the agencies overseeing it. It’s shaping up

New Administration Takes HIPAA Security Rule Complaints Seriously

What HR Pros Need to Know About the Latest OCR Enforcement Update Here’s the key takeaway from the latest HIPAA Security Rule enforcement update: the

Boost Benefits Compliance (and Your HR Cred!)

We’re well on our way into the second quarter, and now’s the perfect moment to showcase your benefits compliance skills. With deadlines looming and tasks